Insights

April 2024March 2024 Jan 2024 Dec 2023 Nov 2023

- Do credit unions really need five companies to manage $18B of statutory liquidity?

- The PSCU-Co-op mega-merger: Three (hard) lessons for Canadian credit unions

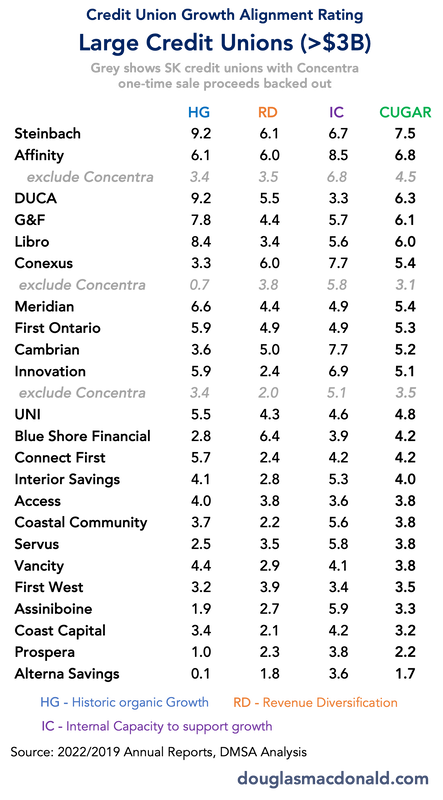

- For Saskatchewan's credit unions, what comes after Concentra?

- Credit unions are getting leaner - and need to keep going

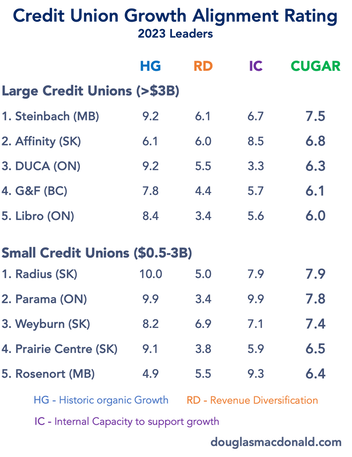

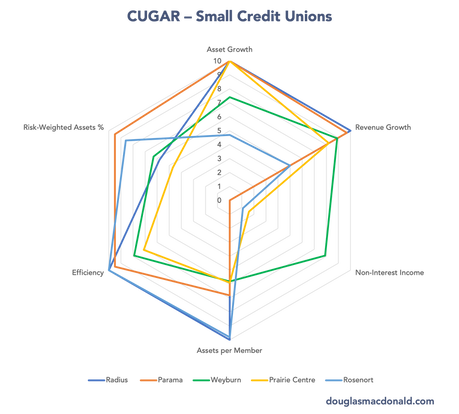

- Here are Canada's credit union growth leaders

- Introducing CUGAR: Recognizing credit unions built for growth

RSS Feed

RSS Feed